Welcome to your go-to guide for unravelling the mysteries of capital gains on bonds. Whether you’re a seasoned investor or new to financial ventures, understanding the tax implications associated with bonds is crucial for your financial journey. In this guide, we’ll break down the basics of capital gains related to bonds in an easy-to-understand manner.

What are Capital Gains on Bonds?

In simple terms, capital gains on bonds refer to the profits you make by selling a bond at a price higher than your initial investment. By understanding the dynamics of capital gains on bonds, you can make informed decisions and optimize your financial strategies.

Types of Bonds

Before diving into tax details, let’s explore the various types of bonds and their subsets:

Listed Bonds

Officially listed on stock exchanges like NSE and BSE. Governed by SEBI regulations for transparency.

Unlisted Bonds

Not listed on recognized stock exchanges.Traded over-the-counter (OTC) through intermediaries.

Taxable Bonds

Taxable bonds are subject to taxes, offering profits through capital gains and interest. For example, if you invest Rs. 5,00,000 at 10% per annum, the annual interest of Rs.50,000 is added to your total income, taxed based on your income bracket.

Tax-Free Bonds

Utilized by governments and PSUs for national projects, tax-free bonds offer–Tax-free interest income. Categorized returns as long-term or short-term capital gains upon selling.

Tax-Saving Bonds (54EC)

For long-term capital assets, 54EC bonds offer a 100% exemption on LTCG taxes, capped at Rs. 50 lakhs if reinvested within 6 months. Additional deductions of Rs. 20,000 annually are permitted.

Zero-Coupon Bonds

Zero coupon bonds are issued at a discount, and they don’t pay interest upfront. Profits are subject to taxation as LTCG or STCG. Entities like NABARD, REC, and certain government bodies issue these bonds.

Sovereign Gold Bonds

Government-backed SGBs offer gold investments without physical ownership. Taxed under “Income from other sources,” they have a capital gains exemption if held until maturity.

Taxation of Bonds

Interest Income

Interest income is categorised as ‘Income from Other Sources’ and taxed at the prevailing income tax rate.

Capital Gains

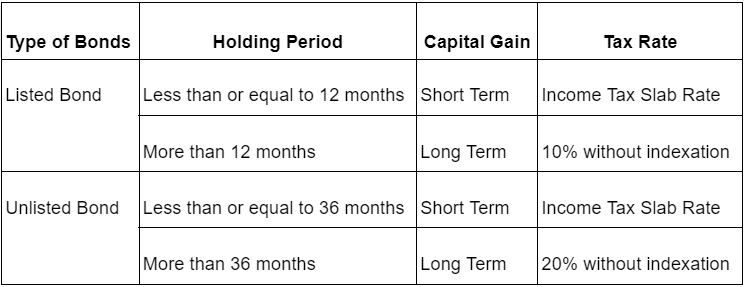

Listed Bonds

LTCG (held >12 months): Taxed at a flat 10%, without indexation.STCG (held <12 months): Taxed at marginal tax rate.

Unlisted Bonds

LTCG (held >36 months): Taxed at 20%, without indexation.STCG (held <36 months): Taxed at marginal tax rate.

Tax Deducted at Source(TDS)

As of April 01, 2023, a 10% TDS rate applies to interest income from both listed and unlisted bonds.

Things To Keep In Mind

- Understand Tax Implications: Grasp income tax slab rates and capital gains tax rates before investing.

- Plan Holding Period: Longer-term investments often have more favourable tax treatment.

- Track TDS: Keep records of TDS deducted for tax filing purposes.

- Consider Tax-Free Bonds: They can provide tax-free interest income.

- Explore Deductions: Claim deductions on interest paid on loans used to invest in bonds.

- Consult a Tax Expert: Due to intricate tax rules, consulting a tax expert is advisable for precise tax planning.

Navigating the intricate landscape of capital gains on bonds requires a comprehensive understanding of the tax implications and diverse bond types. This guide has provided clarity on the distinctions between listed and unlisted bonds, taxable and tax-free bonds, as well as specialized categories like tax-saving, zero coupon, and sovereign gold bonds.

Also, read about ETF vs Mutual Funds

As queries are addressed in the FAQs section, it is evident that choosing the best capital gain bond depends on individual goals and risk tolerance. Seeking personalized advice from a financial advisor and consulting tax experts for precise tax planning are strongly recommended due to the complexity of tax rules. In essence, this guide equips investors, whether seasoned or newcomers, with the knowledge to navigate the complexities of capital gains on bonds and make informed financial decisions.

Frequently Asked Questions

1) Which capital gain bond is the best?

The best depends on your goals and risk tolerance. Consult a financial advisor for personalised advice.

2) What are 54EC bonds?

Also known as capital gain bonds, they offer 100% LTCG tax exemption when reinvesting proceeds from selling long-term assets within six months.

3) How to calculate gain on bond sales?

Subtract the purchase price from the selling price. If the holding period is >12 months, it’s LTCG; otherwise, it’s STCG.

Leave a Reply